Office Hours

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Investment Services, Annuities

Ladd Hidalgo

Office Hours

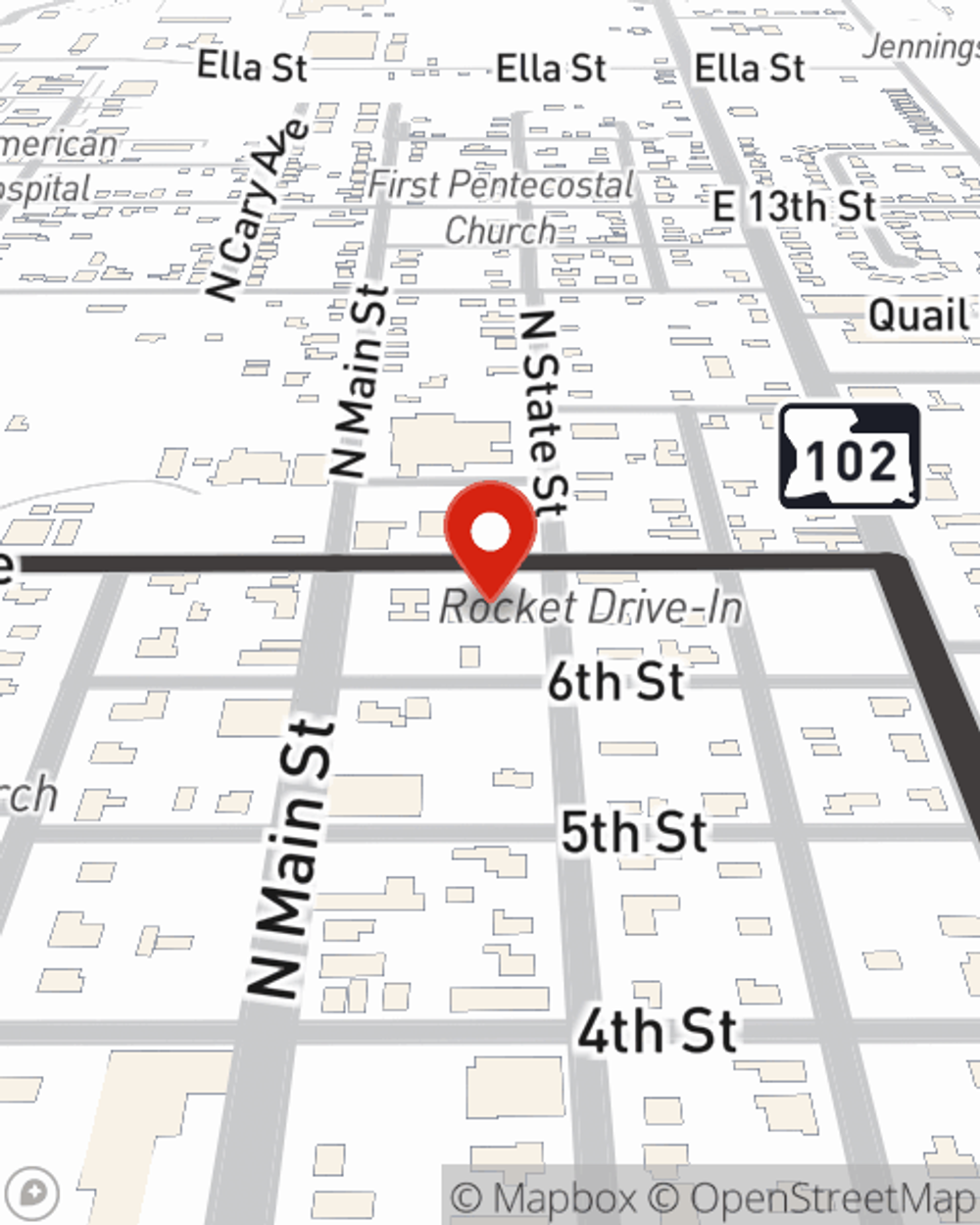

Address

Jennings, LA 70546-4754

Would you like to create a personalized quote?

Would you like to create a personalized quote?

Office Info

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Investment Services, Annuities

Office Info

Simple Insights®

Car maintenance tasks you can do yourself

Car maintenance tasks you can do yourself

To combat auto repair costs that keep climbing, some auto maintenance can be done at home. Here are ones that are usually do-it-yourself.

How to stay safe and help prevent heat illnesses on humid days

How to stay safe and help prevent heat illnesses on humid days

How to help deal with the added risks of breathing trouble, heat exhaustion and mold.

Things to do before going to college

Things to do before going to college

Prepare your student for the transition from home to college. Discuss finances, health, and insurance to help college-bound kids manage classes and personal life.

Social Media

Viewing team member 1 of 4

Charlotte Single

Customer Service Representative

License #683086

Charlotte is a dedicated and experienced insurance professional residing in Iota. With nine years of experience in the insurance industry, she is passionate about providing exceptional service and support to our valued customers. Charlotte finds great fulfillment in helping our policy holders secure their financial future and reducing the burden of knowing they are properly protected.

Outside of her professional life, Charlotte enjoys a variety of hobbies. She has a green thumb and spends her spare time gardening, cooking, and baking delicious treats. Family is at the heart of Charlotte's life; she cherishes moments spent with her two sons, and is the proud grandmother of thirteen wonderful grandchildren, with a fourteenth on the way.

Charlotte's dedication to both her career and her family exemplifies her commitment and caring nature, making her a cherished member of our team and community.

Viewing team member 2 of 4

Ayla Bettevy

Customer Service Representative

License #1002794

My name is Ayla Bettevy, I am 28 and I was born and raised here in Jennings! I am married to my husband, Ryan, going on 5 years and we have two beautiful kids, Baylor Ryan and Katherine James. In my free time I love listening to music and having get togethers with friends and family. I love a good movie night cuddled up with my family and eating popcorn! I absolutely love my job and the ladies I get to work with every single day. I am licensed in Property and Casualty. Give me a call today to see what I can do for you!

Viewing team member 3 of 4

Shyann Crochet

Account Representative

License #1088354

Originally from Hathaway, Shyann lives in Lacassine and has been in the insurance industry for five years. She enjoys forming relationships with our customers and helping them understand everything within their coverages. Shyann loves working alongside such an incredible team here at the agency! Outside of work, you can find her fishing, hunting, gardening, having cookouts, and spending time with her family. Shyann and her husband, Mark, have been married for five years and she has four kids - three boys and a girl. Shyann’s family is her entire world and her motivation to serve our policy holders everyday!

Viewing team member 4 of 4

Nicole Thibodeaux

Account Representative

License #1067909

I was born, raised, and currently reside in Jennings. I started my career with State Farm after an internship through LSUE. I obtained my associate degree in management in December of 2023 before coming on full-time in January of 2024. I am licensed in property, casualty, life, and health. I spend most of my free time watching movies or playing video games with my fiancé and our many cats. I look forward to being able to help my community. Give me a call today to see what State Farm can do for you.

Jennings - LA Full Time

Jennings - LA Full Time

Jennings - LA Full Time

Jennings - LA Full Time

Jennings - LA Full Time

Jennings - LA Full Time